A customs value is the total value of all items in your shipment and determines how much import duty the package recipient must pay. All international shipments are subject to duties and taxes. The shipper/exporter is responsible for including customs value-only statements on the customs or commercial invoice.

NOTE: Please make sure to create an automation rule to add the discount for customs value.

Where does ShipHero get the customs value?

ShipHero will check 4 different places for customs values in order of precedence, as listed below. If the first value is 0, we will check the following value until there is a value greater than 0.

Order Line Item Customs Value

Product Customs Value

Line Item Price

Product Price.

NOTE: If all four options are $0, including the line item price, we send the customs value as $0.01. ShipHero cannot send a value of 0, so if all fields are 0, we will default the value to 0.01.

Where are each of these fields located in the system?

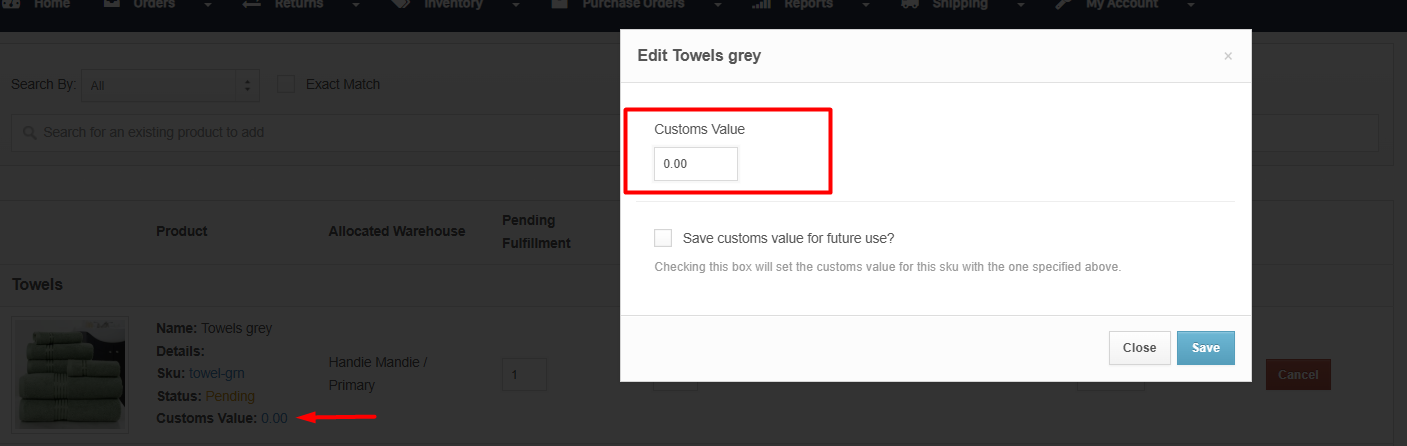

1. Order Line Item Customs Value

Go to the Order Details page and look for the specific product (line item). The value is listed in the Product Details column and is automatically added from the Customs Value specified on the Product Details page.

If needed, you can manually change the value of a product per order by clicking on the amount and following the module prompts.

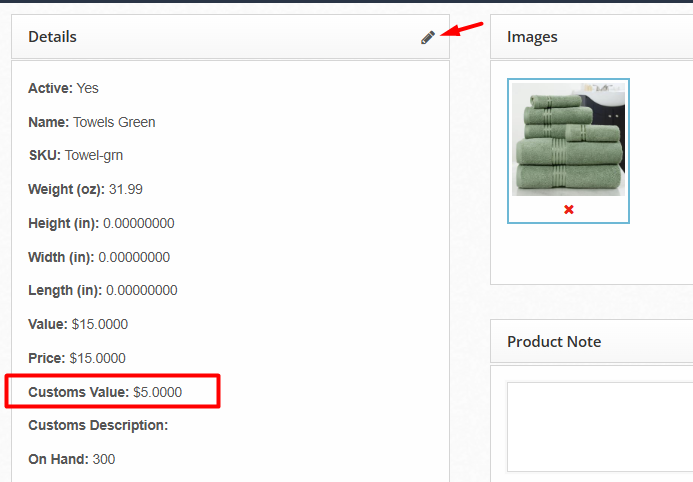

2. Product Customs Value

The Product Customs Value is found on the product details page, as shown below. This field can be updated here for a single product. To update the customs value for multiple products at once, use the Bulk Edit CSV or Bulk Edit module on the Inventory > Products page.

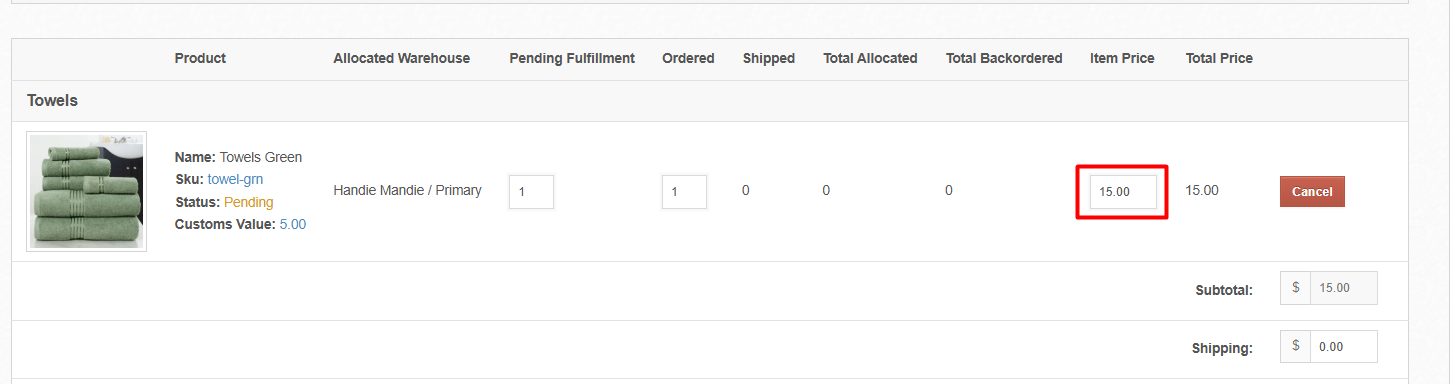

3. Line Item Price

The Line Item Price can also be found on the order details page. This amount does not include any discounts and is pulled from the price specified at the store level when the order is created in ShipHero. Orders created via CSV or the API are also treated as store orders and will use the value specified at order creation. If a manual order is created in the ShipHero platform, the price from the product details page is used unless it was manually adjusted during the order creation process.

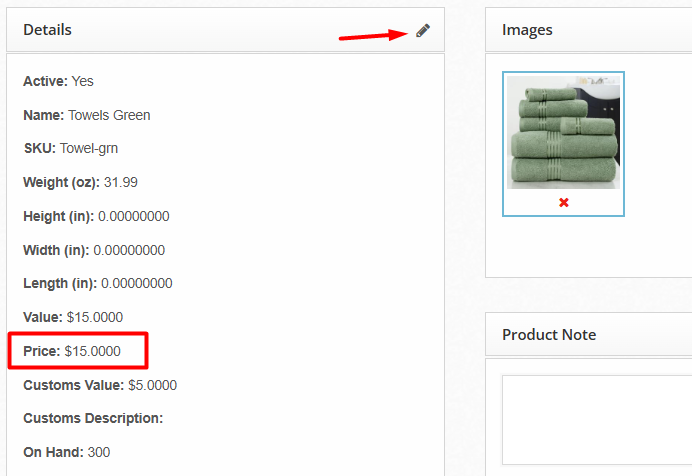

4. Product Price

The product price can be found on the product details page. It can also be updated here for a single product or for multiple using the Bulk Edit CSV or Bulk Edit module on the Inventory > Products page.

How is Customs Value Calculated for Kits?

Because a Kit SKU can consist of one or more SKUs, each with an individual customs value, ShipHero will sum the customs value of the components and apply it to the customs value of the Kit SKU on the order.

For Example:

A kit SKU with three components is on order: one hat, one shirt, and one bag.

The hat's customs value is $6, the shirt's $9, and the bag's $10. Therefore, the kit's customs value is $25.

What if the price of the kit is less than the combined total of the component's customs values?

Often, retailers will "discount" their items when purchased in a bundle rather than separately. In short, the price the customer pays is less than the sum of the components. ShipHero considers the price paid for the Kit SKU and uses that price in relation to the component's total customs values to calculate the adjustment % for the Kit SKU's final customs value.

For Example:

Using the example from above the kit's customs value is $25 based on the total customs value of the components. However, the customer only paid $20 for this kit.

In this case, ShipHero will calculate an adjustment % using the equation below and recalculate the Kit SKU's Customs Value

The price paid for Kit SKU / Combined Customs Value of components = Adjustment %

$20 / $25 = 0.8 or 80%

This percentage is now applied to each individual component's customs value using the equation (Customs Value * Adjustment % =Adjusted Customs Value) and then summed together to get the final customs value for the Kit SKU; $20.