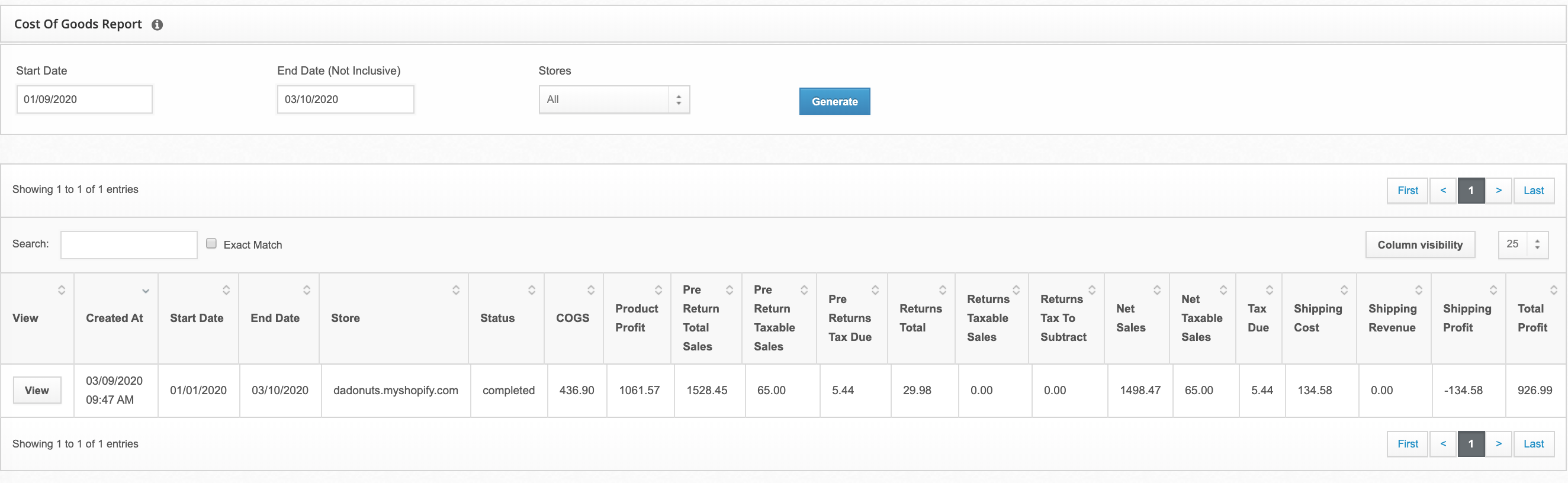

The Cost of Goods, also known as "COGS," is most commonly used to determine the sales tax due for a specific period. You can access COGS in the dashboard by selecting Reports > Cost Of Goods. Filter by the store, use the Column Visibility tab to choose which columns you want to export to CSV or PDF, and then select the date range.

Note: If the report is generating slowly, try shortening the date range.

Discounts and Sale Items

When ShipHero pulls an item's sale price from your e-commerce store, the discount will be reflected in the Price Paying Tax On column.

If a percentage discount is offered on the total price of an order, the percentage is calculated by comparing the total order price and the sum of line items. This is also reflected in the Price Paying Tax On column.