Effective July 1, 2021, the EU will begin enforcing the VAT eCommerce package, which includes new rules regarding eCommerce and VAT. These rules will have an immediate effect on all businesses in the supply chain such as individual sellers and marketplaces. All distance sellers within the EU or trading with the EU will need to redefine their VAT requirements after July. For more information about this change, please reference the European Commission Website.

An overview of the changes that are taking place

- Removing the distance selling thresholds for sales of goods and setting a unified threshold of 10.000 euros

- Expanding the Mini One Stop Shop (MOSS) by launching the new One Stop Shop (OSS)

- Ending the low-value import VAT exemption and introducing the new IOSS

- Online marketplaces will be deemed the seller for collecting and reporting VAT

- New record-keeping requirements will be introduced for online marketplaces facilitating supplies of goods and services

- Special arrangements in order to simplify imported goods with a value of less than €150 in case the IOSS (import one-stop-shop) is not used

How to set VAT up in ShipHero

ShipHero supports setting VAT registration type and ID via automation rules. Each shipment sent to Europe requires this information.

Note: For 3PL accounts, automation rules are set up on the child account.

- Go to app.shiphero.com > Orders > Automation Rules

- Select the + sign to create a new rule

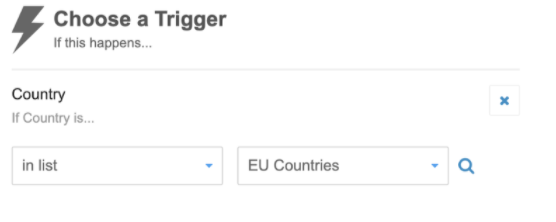

- For shipments to a member country of the European Union, under Trigger select Country > In List > EU Countries.

- Similarly, for shipments to the UK, change the Trigger to match the UK region instead. Options on the UK list include:

- GB

- England

- Northern Ireland

- NIR

- Wales

- Scotland

- UK

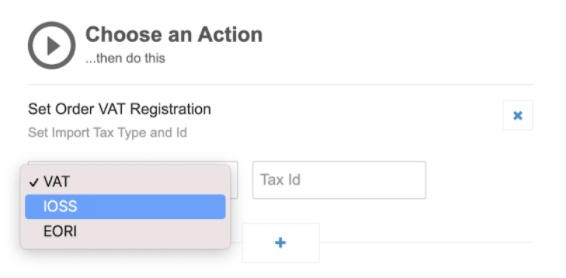

- Under Action, select Set Order Tax Registration > Import Tax Type > Tax ID.

For more information about DDU and DDP shipping, visit our Knowledge Base article.